- Get link

- Other Apps

- Get link

- Other Apps

The idea of money laundering is essential to be understood for these working within the financial sector. It's a process by which dirty money is transformed into clear cash. The sources of the money in actual are felony and the cash is invested in a approach that makes it appear to be clear cash and conceal the identification of the criminal a part of the cash earned.

While executing the monetary transactions and establishing relationship with the brand new prospects or maintaining current customers the responsibility of adopting adequate measures lie on every one who is a part of the group. The identification of such element at first is straightforward to deal with instead realizing and encountering such situations afterward in the transaction stage. The central financial institution in any country offers complete guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to deter such conditions.

Asian Development Bank 2017. The capacity of national authorities and relevant stakeholders to combat the financing of terrorism within their jurisdictions and regionally is especially important.

Https Www Econstor Eu Bitstream 10419 162698 1 891246215 Pdf

Terrorist financing provides funds for terrorist activity.

Terrorist financing key features. The importance of combating terrorist financing. We set out below five features of the Regulations which may be of particular interest to financial institutions. Government-provided financing used to be the principal source of income for terrorist organizations during the cold war period when regional conflicts often were battlefields for the two blocs and each terrorist cause an opportunity to destabilize or disorganize the other bloc.

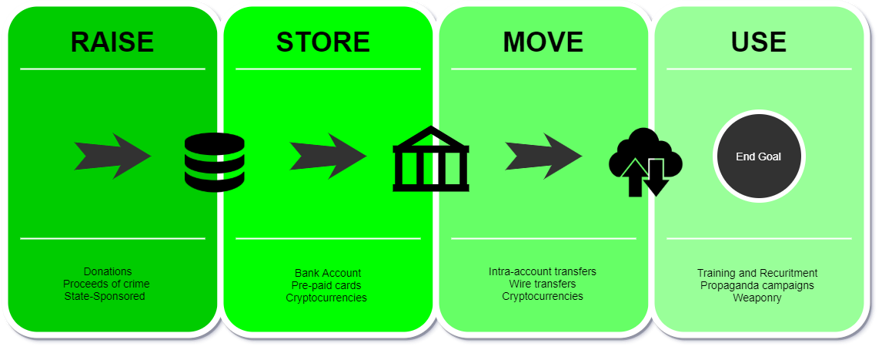

Terrorist organisations require significant funding both for the actual undertaking of terrorist acts but also to other issues. Experience lead to understanding To better understand terrorist financing four factors must considered. Terrorism financing is the provision of funds or providing financial support to individual terrorists or non-state actors.

Terrorist financing often involves smaller amounts of money generated locally when compared to the laundering of criminally-derived funds. In the case of money laundering the funds are always of illicit origin whereas in the case of terrorist financing funds can stem from both legal and illicit sources. Handbook on anti-money laundering and combating the financing of terrorism for nonbank financial institutions.

There is therefore a clear need to enhance cooperation between authorities responsible for combating terrorism and serious crime when financial information is a key part of an investigation. While most of the funds originate from criminal activities they may also be derived from. Terrorism financing is the act of providing financial support funded from either legitimate or illegitimate source to terrorists or terrorist organisations to enable them to carry out terrorist acts or will benefit any terrorist or terrorist organisation.

Expansion of the regulated sector The Regulations expand the regulated sector to. And the individuals entities and cells who comprise the terrorist groups They each have their own financial requirements which leave a traceable trail. Terrorist Finance Tracking Program The Treasury Department initiated the Terrorist Finance Tracking Program to identify track and pursue terrorists and their networks.

On the other hand money laundering always involves the proceeds of illegal activity. Disrupting and preventing these terrorism-related financial flows and transactions is one of the most effective ways to fight terrorism. Most countries have implemented measures to counter terrorism financing CTF often as part of their money laundering laws.

The terrorist groups themselves. Terrorists need money and other assets for weapons but also training travel and accommodation to plan and execute their attacks and develop as an organisation. Terrorist financing is the collection or the provision of funds for terrorist purposes.

Thus preventing terrorists from accessing financial resources is crucial to successfully counter the threat of terrorism. Since that time the TFTP has provided valuable leads that have aided in the prevention or investigation of many of the most visible and violent terrorist attacks and attempted attacks of the past decade. These differences make funds intended for terrorism more difficult to detect than high-value money laundering activity.

Financing is required not just to fund specific terrorist operations but also to meet the broader organisational costs of developing and maintaining a terrorist organisation and to create an enabling environment necessary to sustain its activities. The financial mechanisms they use. It may involve funds raised from legitimate sources such as personal donations and profits from businesses and charitable organizations as well as from criminal sources such as the drug trade the smuggling of.

To maintain the functioning of the organisation to provide for its basic technical necessities as well as to cover costs related to spreading related ideologies. Some countries and multinational organisations have created a list of organisations that they regard as terrorist organisations though there is no. The end of the cold war has dried up this source of financing.

Money laundering is the process of concealing the illicit origin of proceeds of crimes. Combating the financing of terrorismI. Associated with TF techniques or activity.

Combating the Financing of Terrorism is a set of policies aimed to deter and prevent funding of activities intended to achieve religious or ideological goals through violence. The common features of money laundering are hiding the true ownership and origin of the funds taking care of the proceeds in good condition transforming the proceeds using sophisticated methods and constant pursuit of profit or financial gain with. Terrorists require financing to recruit and support members maintain logistics hubs and conduct operations.

Directive EU 20191153 enhances the use of financial information by giving law-enforcement authorities direct access to information about the identity of bank-account holders contained in national centralised registries. The purpose of laundering is to enable the money to be used legally. Terrorist financing uses funds for an illegal political purpose but the money is not necessarily derived from illicit proceeds.

Money Laundering And Terrorism Financing Prevention Manual

Money Laundering Terrorist Financing Are You Aware Anti Money Laundering Compliance Unit

Pdf Modelling Of Money Laundering And Terrorism Financing Typologies

What Are The Typologies Of Money Laundering And Terrorist Financing

The Definitive Guide To Anti Money Laundering Countering Of Terrorist Financing

Combating Money Laundering And The Financing Of Terrorism A Comprehensive Training Guide Workbook 6 Combating The Financing Of Terrorism

Money Laundering Terrorist Financing Opusdatum

Pdf Detecting Money Laundering And Terrorism Financing Activity In Second Life And World Of Warcraft

The Definitive Guide To Anti Money Laundering Countering Of Terrorist Financing

Countering Terrorist Financing Ctf Fighting Terrorism Through Aml Controls Veriphy

Eu Policy On High Risk Third Countries European Commission

Https Www Fatf Gafi Org Media Fatf Documents Reports Mer4 4 Terrorist Financing And Financing Proliferation Mutual Evaluation Malaysia 2015 Pdf

Anti Money Laundering And Counter Terrorism Financing Law And Policy Showcasing Australia Brill

23rd November Editorials Opinions Analyses Legacy Ias Academy

The world of regulations can seem like a bowl of alphabet soup at instances. US money laundering rules aren't any exception. We now have compiled an inventory of the highest ten money laundering acronyms and their definitions. TMP Danger is consulting firm focused on defending financial providers by lowering risk, fraud and losses. Now we have big financial institution experience in operational and regulatory risk. We have a robust background in program management, regulatory and operational danger as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus money laundering brings many adversarial penalties to the organization because of the risks it presents. It increases the chance of major dangers and the opportunity value of the bank and finally causes the financial institution to face losses.

Comments

Post a Comment